Trump to Inherit Years of Steep Inflation: 4 Things to Know

Inflation was the chief issue for millions of Americans going into the 2024 election.

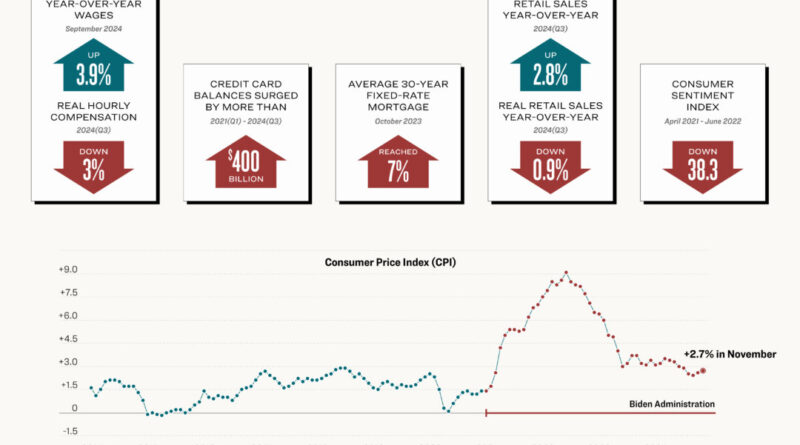

When President Donald Trump left office in January 2021, the annual inflation rate was 1.4 percent. When he returns to the White House next month, the consumer price index (CPI) will be roughly double, at close to 3 percent.

Consumer inflation has surged 21 percent on a cumulative basis since January 2021. Many goods and services have increased at a higher level over the last few years, be it electricity (28 percent) or bread (25 percent).

Treasury Secretary Janet Yellen doesn’t expect prices to drop to pre-pandemic levels.

“I don’t expect the level of prices to go down. Some prices will be higher than they were before the pandemic and will stay higher,” she said in an exchange with Sen. John Kennedy (R-La.) in February.

This cumulative inflation effect, especially in such a short timeframe, has weighed on businesses and households in various ways.

Treasury Secretary Janet Yellen speaks at an event in Washington on Nov. 2, 2023. Madalina Vasiliu/The Epoch Times

Wages

Nominal (non-inflation-adjusted) wage growth has soared about 20 percent, and the November jobs report highlighted that wages are still rising at a year-over-year pace of 4 percent.

While wages have been rising faster than inflation since May 2023, they have not fully caught up to inflation. When workers’ earnings are adjusted for inflation, they have yet to return to their pre-January 2021 levels.

A hiring sign at a restaurant in Columbia, Md., on June 15, 2024. Madalina Vasiliu/The Epoch Times

Consumer Spending and Debt

Economists say the consumer has propped up the post-pandemic economy, and there is evidence to support the idea.

Retail sales growth has been solid, while consumer spending has lifted the GDP growth rate. The United States is coming off a record Thanksgiving-to-Cyber Monday stretch.

The story might be perceived differently when adjusting for higher prices, which would indicate that retail sales have been lower than the headline numbers.

In October, for example, retail sales were up 2.8 percent from the previous year. However, according to Charlie Bilello, the chief market strategist at Creative Planning, real retail sales were down 0.9 percent year-over-year.

Shoppers are spending more because many prices for goods and services are higher. Households have struggled to keep up, forcing many to take on debt to cover their living expenses.

The New York Fed’s third-quarter Household Debt and Credit Report found that credit card balances have surged by more than $400 billion to a record $1.17 trillion since the first quarter of 2021. Personal finance resource hub WalletHub estimates that total credit card debt is $1.29 trillion after revising the numbers for inflation, which would be $185 billion below the 2007 record.

Additionally, underlying trends have formed in recent years, including the rise of buy now, pay later schemes.

People line up outside of Macy’s flagship store before the store opens on Black Friday, in New York City on Nov. 29, 2024. Adam Gray/AFP via Getty Images

Interest Rates

The Federal Reserve (Fed) launched its new easing cycle in September, following through with a jumbo half-point interest rate cut. It has since lowered rates by 25 basis points, and investors anticipate another quarter-point reduction to the benchmark federal funds rate at the December policy meeting.

Now that the central bank is in a new rate-cutting cycle, the monetary authorities have questioned whether they should have raised rates sooner to combat inflation.

“If you had perfect hindsight you’d go back, and it probably would have been better for us to have raised rates a little sooner,” Powell said in a May 2022 MarketWatch interview.

Fed officials initiated quantitative tightening—a blend of higher interest rates and balance sheet reduction—in March 2022, when inflation was 8.5 percent.

In his speech at the annual Jackson Hole retreat in August 2022, Powell sent chills throughout the financial markets, warning that “some pain” was coming.

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” he said in prepared remarks.

Policymakers instituted 11 rate hikes, bringing the target policy rate to a range of 5.25 and 5.5 percent, a 23-year high.

Federal Reserve Chairman Jerome Powell prepares to deliver remarks in Washington on Nov. 8, 2023. Chip Somodevilla/Getty Images

Despite the Fed defying doom-and-gloom expectations, households have taken debt to record levels.

The delinquency rate on consumer loans was close to 3 percent in the third quarter, the highest since 2012.

Sentiment

The United States may have missed a recession, but the country has been entrenched in the so-called vibecession.

Economists have been stumped over the public’s sour assessment of current economic conditions. If the GDP is growing, inflation is easing, and the labor market remains intact, why do consumers maintain a dim view of the economy?

A new term was recently introduced into the econ lexicon: vibecession—the disconnect between the economy’s health and how people feel about it.

Though consumer sentiment has rebounded in the second half of 2024, it is not where it was before 2021.

People shop at a grocery store in Canton, Mich., on Oct. 11, 2024. Madalina Vasiliu/The Epoch Times

Although the country has not met the technical definition of a recession—back-to-back quarters of negative GDP growth—many Americans feel the United States has been in a downturn.