Government Spending Decreased Americans’ Purchasing Power: Reports

News Analysis

Some have blamed inflation on supply shortages due to the pandemic and Russia’s invasion of Ukraine; and still others point to corporate greed taking advantage of crises to make excessive profits.

However, two recent reports from the Federal Reserve undermine these arguments.

The GSCPI supply chain report showed that the index spiked in 2020 and again in 2021, which coincides with government lockdowns in response to the COVID-19 pandemic.

The GSCPI fell sharply again two months later, however, and has been trending in negative territory for most of the past two years. This indicates that supply chains had recovered by the start of 2023 and have generally been in better shape than before the pandemic ever since.

“Constrained supply chains are not a reasonable explanation because prices did not return to trend as output recovered,” Peter Earle, senior economist at the American Institute for Economic Research, told The Epoch Times. “Nominal spending continues to surge, indicative of a demand side issue.”

EJ Antoni, an economist at the Heritage Foundation, likewise argued that while supply chain interruptions caused prices to go up temporarily in certain industries, such as automakers, they fail to explain persistent and widespread inflation.

The GSCPI data, he said, “speaks to why that entire narrative about inflation being caused by supply chains was just wrong.”

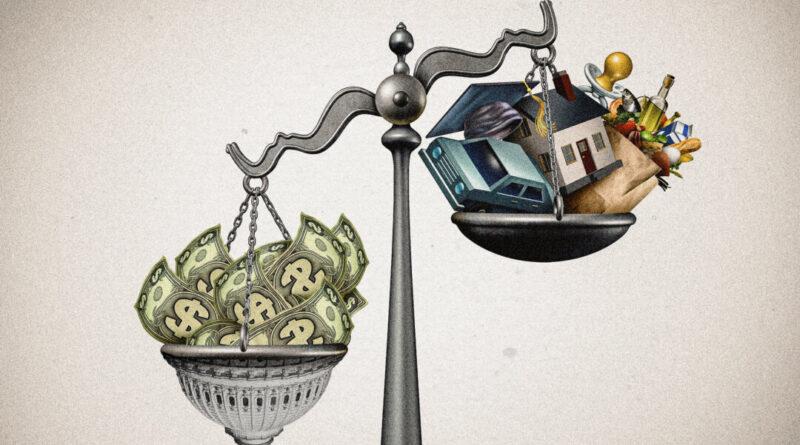

Illustration by The Epoch Times

“We didn’t have inflation simply because supply chains were snarled; we had inflation because the government spent, borrowed, and printed trillions upon trillions of dollars it didn’t have,” he told The Epoch Times. “If we actually did believe that higher prices were caused by these supply-chain difficulties, then what we should have seen as supply chains normalized was not only inflation coming down but prices coming down.”

Indeed, prices for both new and used cars, which were impacted by supply chain issues, have been trending downward in 2024, according to Fed data, and dealers are now offering greater incentives to move vehicles off their lots as carmakers resolve their bottlenecks. But average prices throughout the U.S. economy are not coming down, suggesting factors other than supply chains have been at work.

“Why do we still have, overall, 20 percent higher prices than we saw in January of 2021?” Antoni said. “It’s because the government has debased the currency to pay for all its excess spending.”

Chris Edwards, a fiscal expert at the Cato Institute, said this underscores the urgency for the incoming Trump administration to bring down federal spending.

“There’s general agreement among economists now that it was that big spending that Biden did—that spiked inflation,”Edwards told The Epoch Times

“I think the biggest risk for Trump and the Republicans is if inflation spikes again.”

How Government Debt Fuels Demand

“The federal government borrowed heavily to meet its spending needs in 2020 and 2021, and that borrowing was converted by the banking system into funds that fueled the rise in prices,” Beach wrote.

He cites $8.8 trillion in federal deficits between fiscal year 2020 and 2023, which the Federal Reserve funded by buying government debt, which is then passed on to private banks within the Federal Reserve system, which in turn is lent out to customers.

The Federal Reserve Board of Governors in Washington on Aug. 12, 2024. Madalina Vasiliu/The Epoch Times

This led to a 25.4 percent increase in bank assets between 2020 and 2021, which banks passed on as loans, Beach wrote. Consumer loans increased by 19.2 percent; mortgages grew by 12.1 percent; and total bank loans increased by 13.7 percent.

This created a $5.4 trillion increase in the M2 measure of the U.S. money supply, which includes money in circulation and credit, between 2020 and 2022, corresponding with price hikes, including a 21 percent increase in food prices and a 43 percent rise in home prices.

“Prices probably will not fall back to 2020 levels,” Beach stated, “but Congress can help increase economic efficiency and productivity, which will help raise incomes and, thus, close the family budget squeeze.”

This could include cutting regulations, tax reforms, and other measures to help the U.S. economy produce more, and more efficiently, to better align supply with demand. But it would also include getting federal budgets back into balance.

Antoni said aside from getting spending under control, “we also have to rein in the Federal Reserve.”

“If the big spenders in Congress and the White House are the bank robbers, the Fed is the getaway driver. It’s the Fed that is actually devaluing the currency by printing more of it in order to finance all that government spending,” Antoni said.

‘Greedflation’

Other explanations for inflation include what has been called “greedflation.”

People shop at a grocery store in New York City on June 20, 2024. Samira Bouaou/The Epoch Times

She blamed food retailers such as Walmart, Costco, Kroger, and Ahold Delhaize (a parent company which includes, among others, Stop & Shop), as well as a small number of dominant producers of cereals, eggs, and meat, for earning outsized profits from a geopolitical crisis, charging that “the pandemic gave these big food conglomerates an excuse to jack up prices on grocery staples beyond what was necessary to cover increases in their costs from inflation or from supply chain disruptions.”

Warren called for the government to “regulate grocery stores and corporate food producers.”

In August, Vice President Kamala Harris similarly called for a ban on “price-gouging” in the food industry.

This argument, too, appears to be refuted by economic data, which show little evidence of companies earning above-normal profits in most industries.

While the report noted price markups of more than 10 percent in certain industries, such as autos, petroleum products, department stores, and repair and maintenance services, the authors argued that “the surge in inflation through June 2022 was broad-based, with prices also rising substantially outside of these sectors.”

“Aggregate markups—the more relevant measure for overall inflation—have stayed essentially flat since the start of the recovery,” the report stated.

“The greedflation explanation is just absurd,” Earle stated. “The idea that hundreds of thousands of businesses large and small began to raise their prices at almost exactly the same moment, and then decided to slow the rise of those prices at the same time—and eventually dis-inflate their prices in unison as well—is an insult to any reasonable intelligence.

“The primary cause of the inflation was the Fed failing to stabilize nominal spending,” he said.