Is London Hiding a Regional UK Recession?

While the prospect of a UK recession is looming once again with the recent hike in interest rates, it appears the country has managed to sidestep it so far.

But is London’s outsized finance-driven economy masking the fact that some British regions have actually been in a recession?

Official estimates of local economic output suggest that may be true. And some economists have been concerned that the UK’s spatially imbalanced economy is not only unhealthy for less wealthy regions but may also spell future stagnation or decline for the UK as a whole.

A recession is commonly defined as two consecutive quarters of decline in gross domestic product (GDP), which measures the total monetary value of all the final goods and services produced in an economy during a time period.

In the case of a short recession, we don’t find out about it until after having got out. The last recession in the UK was in the first two quarters in 2020, when businesses and some public services were shut down.

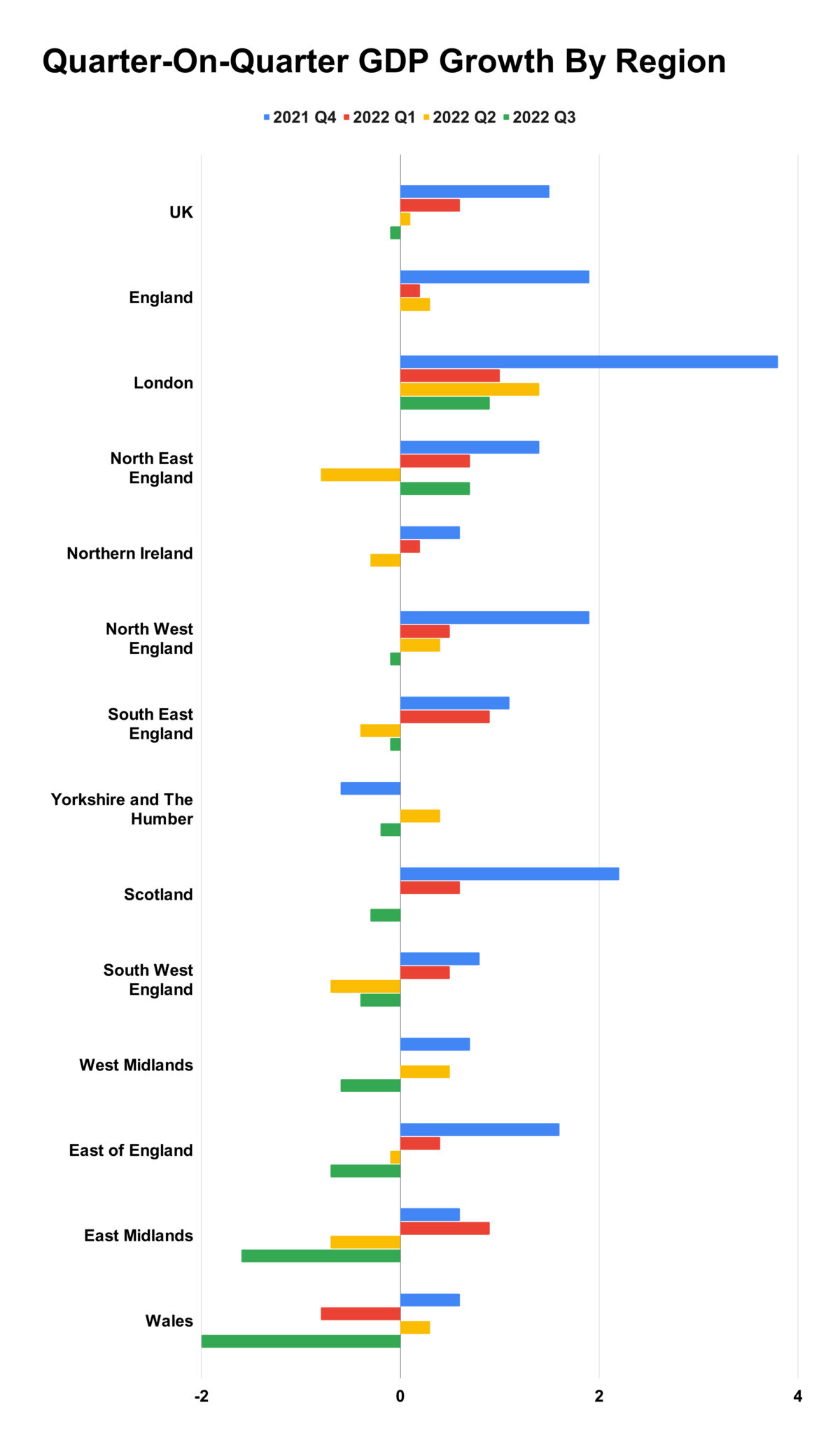

The latest preliminary estimates by the Office for National Statistics (ONS) suggest that four regions in England—South East, South West, the East of England, and the East Midlands—may have technically been in a recession during the second and the third quarter last year.

The same dataset showed that London was the only region across the UK that had consistent GDP growth in all four quarters ending September 2002.

Economist Philip Pilkington warned earlier this year that regional decline and sectoral shifts in employment could be indicative of “chronic stagnation.”

It’s worth noting that while GDP is useful as an internationally comparable economic metric, it doesn’t tell the whole story of the well-being of an economy or the people in it.

And it’s “certainly true” that national GDP figure “has not revealed regional disparities,” Joel Clovis, lecturer in economics at the University of East Anglia, said, adding that it would be useful to examine how different sectors are doing.

Chris Hobson, director of policy at the East Midlands Chamber of Commerce, said the region’s hospitality sector “had a really, really hard time of it,” but as a whole, the region seems to perform quite well because it has “more eggs in one basket in terms of sectors,” such as aerospace and automotive manufacturing and nuclear power generation.

But with the resignation of two prime ministers and a controversial mini-budget last year, business investment in the East Midlands has “struggled quite a bit” before “starting to pick up again,” Mr. Hobson told the Epoch Times. He also warned that rising interest rates can damage business investment.

Last month, the Bank of England hiked interest rate to 5 percent, the highest since 2008, in order to control inflation that was stickier than expected, pushing up mortgage prices and the cost of business borrowing.

Imbalanced And Centralised

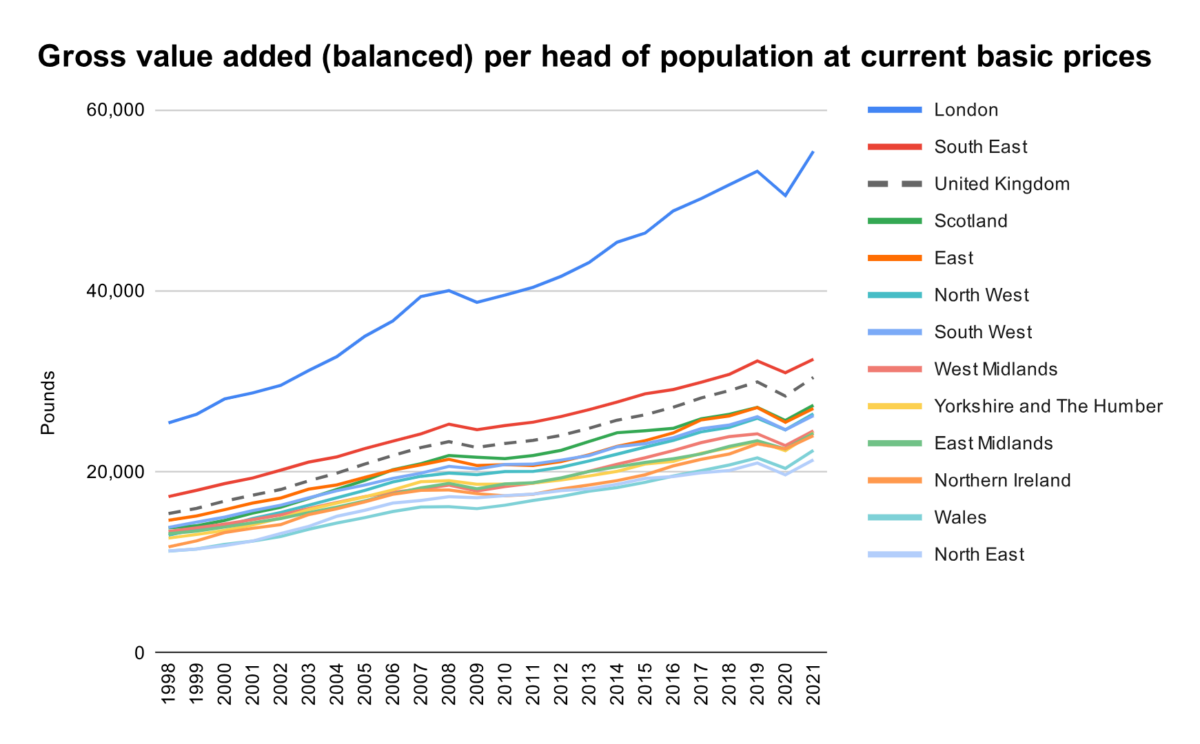

In the tax year 2021/22, London contributed to more than 21 percent of the UK’s total revenue. For the past two decades, the capital’s economic productivity, measured by gross value added (GVA) per head, has also grown at a faster rate than the rest of the UK.

By 2021, London’s GVA per head was 70 percent higher than that of South East England, the only other region with above national average productivity, and almost 16o percent higher than that in North East England, where productivity was the lowest.

Mr. Clovis said he expects London will continue to do well. But “the issue is whether or not the expectation … changes to a downward expectation for the rest of the country,” he said, noting that the negative impact of Brexit, such as labour shortages, are still playing out.

Studies that examined a range of metrics, such as productivity, education attainment, and health, have found that the UK has some of the largest regional imbalances among advanced OECD countries.

Mr. Hobson said while it’s good to have London, the country’s economy has less resilience if we put all eggs in one basket.

While the UK has several large cities across the country, Andrew Carter, chief executive at Centre for Cities, told the Treasury Committee they have been underperforming and that “largely explains the regional imbalance.”

Analysing the possible causes of the inequality, a column published by the Centre for Economic Policy Research said the deindustrialisation, which drove regional economic inequality across the industrialised economies, had gone “further and faster in the UK than in Western Europe’s other most-industrialised regions,” while London took off as a global financial centre.

The authors recommended a focus on STEM, transport, and innovation to boost regional economies.

Others suggest more localised decision-making and longer-term investment are also key to the solution.

Marcus Johns, research fellow at think tank IPPR North, told the Treasury Committee that apart from being one of the most imbalanced, the UK is also “the most centralized country of comparable countries in the OECD” and in need of “long-term sustained investment at a scale that survives political change and is prevalent throughout the business cycle.”

Compared to the other countries, the UK’s devolution of power to local government came later, and to a lesser extent, said Jessica Bowles, director of strategic Partnerships and impact at Bruntwood, Northern Powerhouse Partnership.

“We are giving programmes that government has already designed and determined to local places to administer, not saying, ‘What do you need?’”

Mr. Hobson echoed the sentiment, saying it’s “really important” to have a “long-term strategic plan” instead of “short-term to reactive” policies and energy.

Sebastian Berger, senior lecturer in economics at the University of the West of England in Bristol, cautioned against solely focusing on monetary metrics

“A region like London might be overall, as a whole, growing, but that is not necessarily giving you an idea of what are the living conditions of every citizen of every class of every part of society,” he told The Epoch Times.

Mr. Berger argues that the Social Fabric index, which examines a range of factors including education, crime, environment, and trust, provides “a much more holistic view of the social fabric of society beyond.”