Bank of England Will Not Follow US Rate Cut | Financial News

The US central bank has declared an interest rate reduction, just hours ahead of the anticipated decision from the Bank of England to maintain its current stance.

The Federal Reserve lowered its primary funding rate by a quarter point, establishing a new target range of 4.25%-4.5%, aligning with market predictions, but indicated that any future cuts would be implemented more gradually.

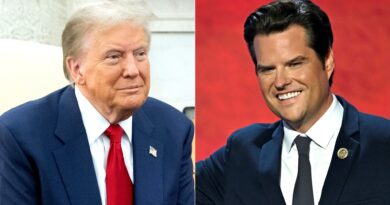

A resurgence in inflation is a significant concern, especially with the potential for new trade tariffs under the incoming Trump administration beginning on January 20, which could accelerate price growth for US consumers in the New Year due to increased costs of imported goods.

Latest on Money: A large number of recent pension credit claims have been denied

Tuesday’s data reflecting resilient consumer spending serves as another reason for Fed policymakers to approach inflation with caution moving forward.

The Federal Open Markets Committee is now projecting two rate cuts in 2025, a revision from earlier market expectations of four cuts just weeks prior, aligning with the Fed’s guidance issued in September.

Fed Chair Jay Powell informed reporters that robust growth, better employment figures, and progress in mitigating inflation indicated that the central bank is in a “favorable position”.

However, he noted that “policy uncertainty” stemming from the forthcoming Trump administration poses concerns regarding inflation forecasts among several committee members.

“We lack substantial insight into the actual policies, making it premature to draw any conclusions,” he added.

Government bond yields, indicative of anticipated future interest rate trends, have slightly increased.

The dollar gained strength, rising 0.5% against both the pound and euro, while major US stock markets saw declines.

The Fed’s decision was made public just hours before the Bank of England is set to disclose its own interest rate decision.

A cut is not anticipated, while financial markets predict a similar outlook on potential interest rate adjustments in the future.

UK borrowing costs have surged sharply this month, with the difference between British and German 10-year bond yields reaching its highest point in 34 years earlier on Wednesday.

This reflects the contrasting interest rate expectations between the Bank of England and the European Central Bank, which has consistently reduced rates to stimulate the eurozone economy.

The UK is grappling with elevated rates of both wage and price growth.

Concurrently, economic growth has come to a halt.

This situation presents a unique challenge for the Bank.

Governor Andrew Bailey has acknowledged that the budget’s impact on businesses raises significant questions regarding the future trajectory of interest rates.

Concerns revolve around how firms may attempt to pass on costs from tax increases and minimum wage hikes in the form of higher prices.

Conversely, the pressure on wage growth could potentially lessen if firms fulfill their threats to curb pay increases due to budgetary pressures.

Currently, it appears that UK borrowing costs will remain elevated for an extended period, which is intended to deter economic growth while simultaneously escalating the government’s expenses to service its debts.

While it is widely believed that the Bank will maintain its current rate on Thursday, financial market forecasts have shifted regarding a reduction in February, dropping from nearly certain to a mere 50% probability following the latest data on wages and inflation.

As it stands, only two rate cuts are currently anticipated for 2025.

The Bank’s commentary on current price pressures will be scrutinized closely.

Regarding the US outlook, Matthew Morgan, head of fixed income at Jupiter Asset Management, remarked, “Currently, the market expects just two additional cuts throughout 2025. This is not shocking given the resilience in consumer spending, the uncertainty surrounding policies (particularly tariffs), and the overall health of jobs.”

“However, we predict that expectations for US rate cuts will escalate in the upcoming year as growth slows. The labor market is evidently cooling, inflation appears to be softening, and Europe and China are hindering global growth.”

“Considering the high inflation during the Biden presidency was unpopular among the public, it is likely that Trump will exercise caution regarding inflationary policies, such as tariffs. Coupled with potential government spending cuts in the US, next year may present favorable conditions for the performance of government bonds.”